This is the 2023 Year-End Real Estate Market Report for Fort Collins CO

Sales:

In 2023, there were 1,993 home sales in Fort Collins CO, a decline of 11.1% from the 2,240 homes sold in 2022. With the exception of December 2023, total sales in each month were less than the same month the previous year.

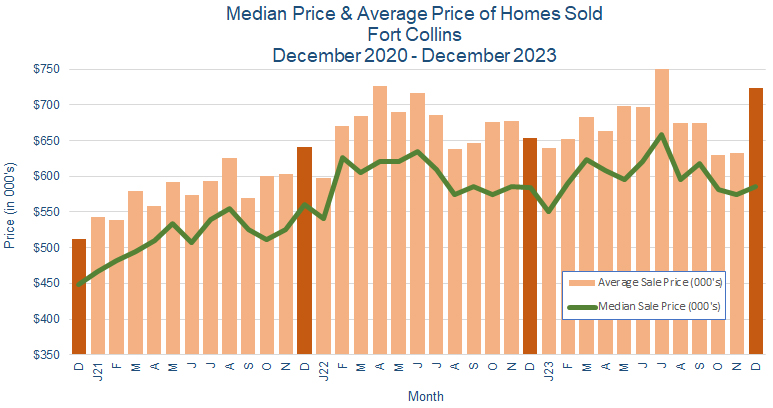

Prices:

Home prices fluctuated in 2023, with an upward trend during the first half of the year, followed by a downward trend in the latter half. The median price ended the year at $585K, exactly where it ended 2022, but peaked in July 2023 at $659K. The average price spent most of the year in the mid-to-upper $600K range, but ended the year at $723K, with an annual peak of $750K in July 2023.

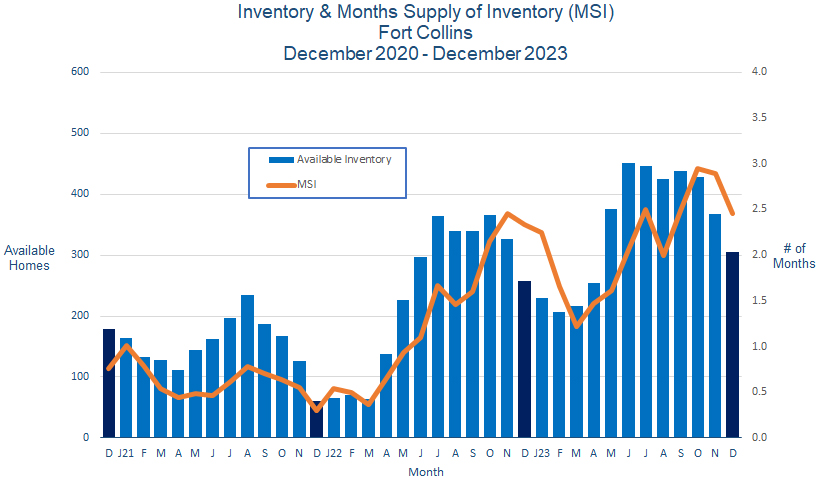

Inventory:

The inventory of homes available for sale in Fort Collins CO in January 2023 stood at 229 homes, began to rise in March 2023, and attained levels by June 2023 higher than any month during the previous three years, only beginning its seasonal decline in November 2023 and ending the year with 305 homes on the market.

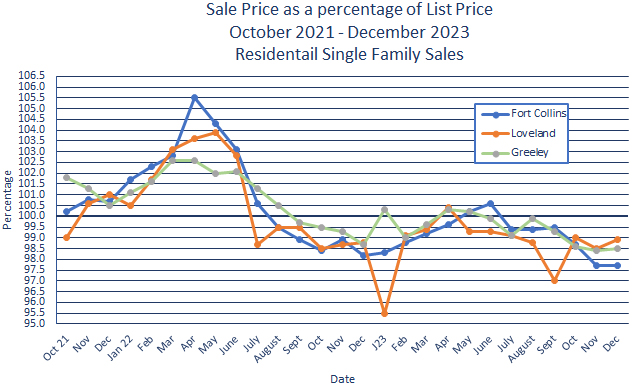

Sales Price vs. List Price:

In January 2023, homes in Fort Collins CO were selling for 98.3% of asking price. That peaked at 100.6% in June 2023, and ended the year at 97.7%

Summary:

2023 was an interesting year for the Northern Colorado real estate market. It began slowly, with an unsettled economic outlook and high interest rates, began to pick up some momentum as recession fears abated and interest rates showed signs of moderating, and then slowed again as structural imbalances in supply and demand manifested themselves.

There are several factors at play currently. First, home prices remain high, with potential sellers facing increased costs of home replacement. Interest rates, while moderating, show no signs of returning to the levels that drove the high market activity of years past. Conversely, the buyer pool has contracted, as wages have not kept pace, and home affordability issues are impacting more people. And the overall economic outlook remains uncertain.

Where once we were able to make reasonably confident predictions about the regional housing market based on local economic factors, and where once the housing market was a significant driver of national economic activity, that’s no longer the case. Investment decisions and consumer confidence are increasingly sensitive to national and international issues and events, and the housing markets, both national and local, are heavily influenced by those.

The economic and social stability of the region will keep those influences manageable, but their uncertain nature will limit our ability to do more than report to you what’s going on as it happens. We’ll be keeping a very close eye on the market for you, so stay tuned. And if you have questions, please give us a call – we’re always here to talk to you.