This is the June 2024 Real Estate Market Update for Fort Collins CO

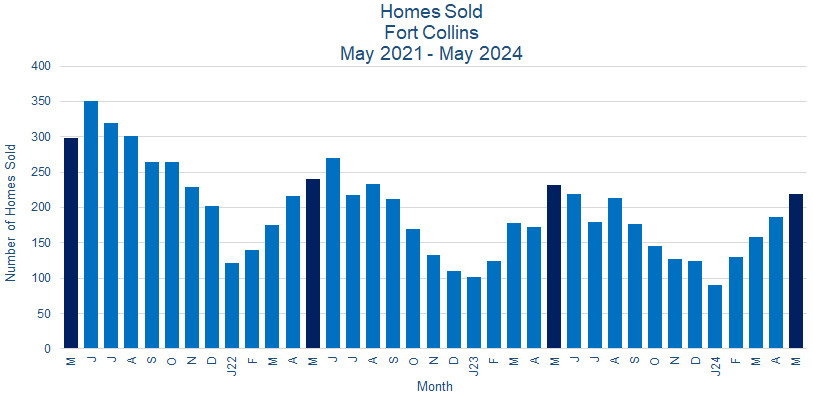

Sales:

219 homes sold in Fort Collins CO during May 2024, a gain of 17.1% from the 187 homes sold in April 2024, but a drop of 5.9% from the 232 homes sold in May 2023. Year to date sales of 786 homes are down 3.1% from last year’s 810 sales for the same period.

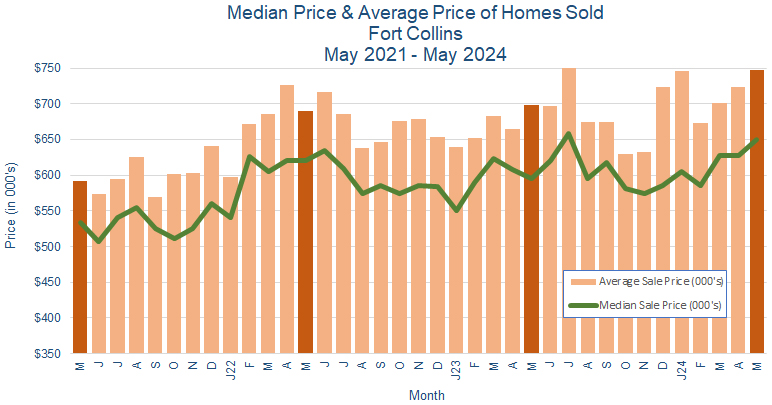

Prices:

Home prices rose in May 2024. The median price of homes sold during the month was $650K, up 3.5% from $628K in April 2024, while the average price rose 3.2% to $747K from $724K for the same period. While these results reflect the specific homes sold during the month, and are therefore subject to random variations, we are seeing a moderate upward trend forming, even as inventory is rising.

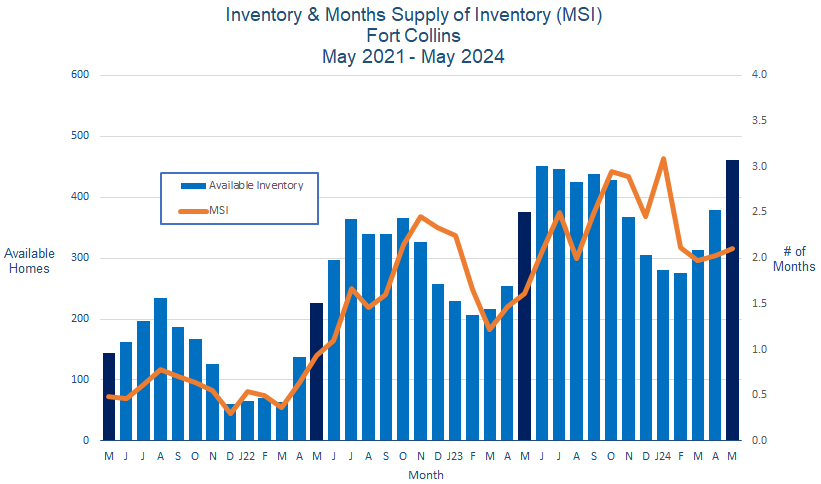

Inventory:

The inventory of homes for sale in Fort Collins CO continued to rise - there were 461 homes on the market at the end of May 2024, up 21.6% from 379 homes for sale at the end of April 2024. The Month’s Supply of Inventory (MSI) rose to 2.1 months.

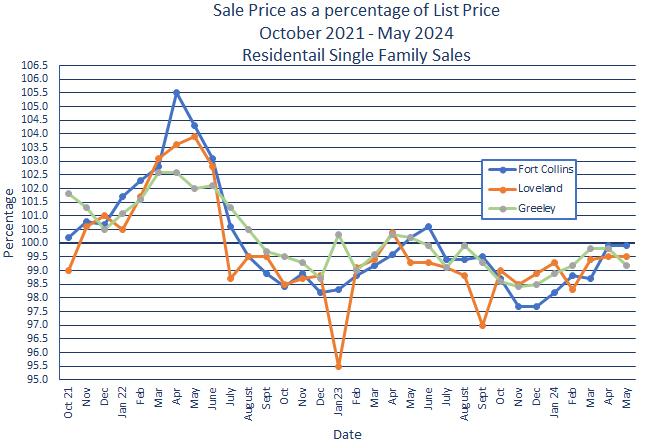

Sales Price vs. List Price:

In May 2024, homes in Fort Collins CO sold for 99.9% of asking price, unchanged from April 2024.

Summary:

So far in 2024, the Northern Colorado real estate markets are experiencing sales levels similar to 2023, moderately rising prices, and rising inventories. There hasn’t been a “normal” year post-Covid for comparative analysis, so each new year presents unique challenges in understanding what’s happening. This year looks to be a continuation of the results and patterns we saw last year.

We’re now into the start of what has traditionally been our busiest season, and sales are a bit slower than we expected, most likely due to a combination of previous year’s price increases, high interest rates, the failure of wages to keep pace with inflation, and concern about the state of the economy. Price increases, though moderate, are likely driven by inventory levels that, while currently increasing, are less than optimal, along with some secondary effects of inflation and a bit of competition for the more desirable homes currently for sale.

Our best guess for now is that at least until fall, we’ll see results similar to what is currently happening. At this time, we don’t see any signs of major instability or stimulus at the local, regional levels or state-wide levels. But we’ll be closely monitoring the markets, and we’ll keep you informed and up to date. In the meantime, please give us a call if you have any questions or just want to chat about what’s happening – we’d love to talk to you.