This is the May 2023 Real Estate Market Update for Greeley CO

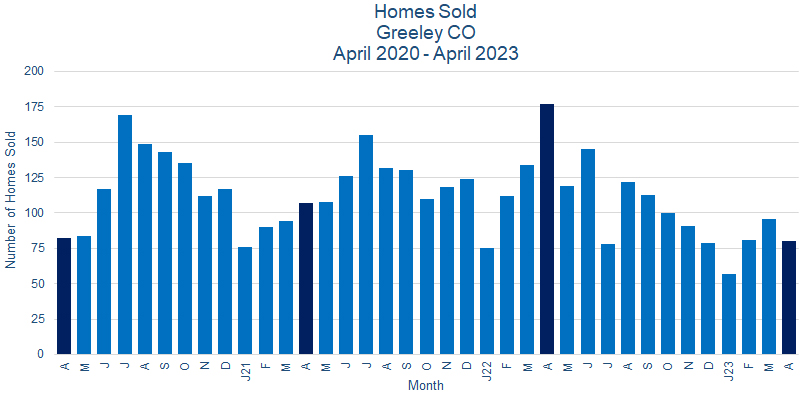

Sales:

Greeley CO home sales fell in April 2023. 80 homes sold, a decline of 16.6% from the 96 homes sold in March 2023, and a decline of 45.2% from the 177 homes sold in April 2022.

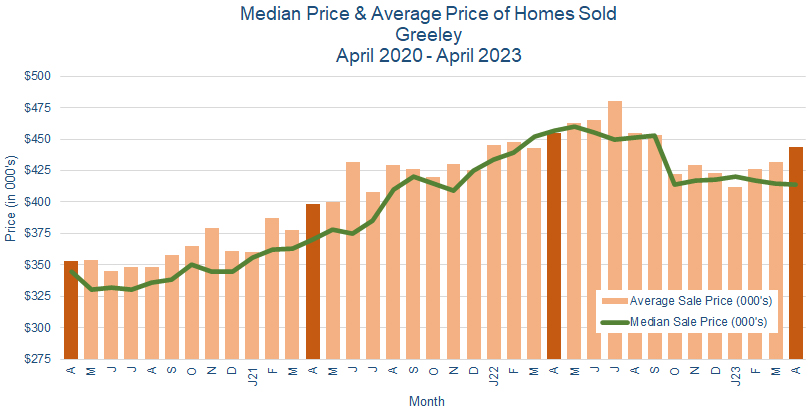

Prices:

Home prices were mixed in April 2023. The median price was down 0.3% to $414K from $415K in March 2023, while the average price was up 2.7% to $444 from the previous month's $432K. These numbers reflect only those homes sold during the month and are within the range of normal monthly fluctuations for this data set.

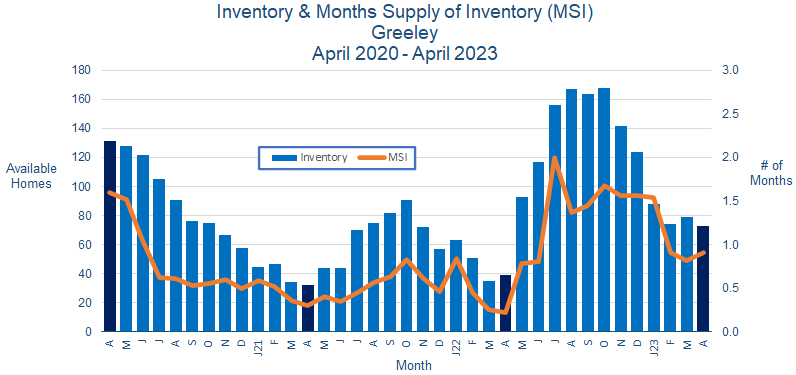

Inventory:

The inventory of homes for sale in Greeley CO fell in April 2023. There were 73 homes available for sale at the end of the month, down 8.2% from the 79 homes on the market at the end of March 2023. The month's supply of inventory (MSI) rose to 0.9 months from the previous month's 1.5, as inventory declines outpaced sales losses.

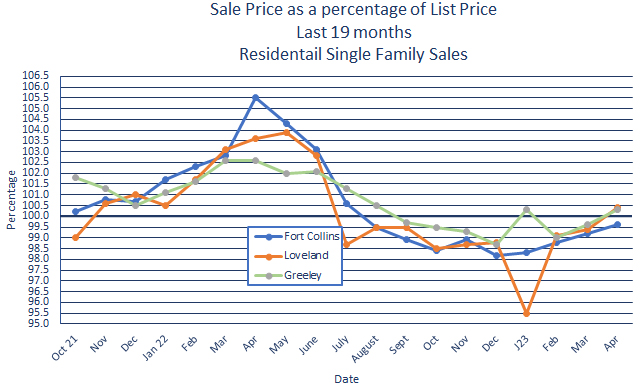

Sales Price vs. List Price:

In April 2023, homes sold for an average of 100.3% of listing price, up from the previous month's 99.6%.

Summary:

It's not really surprising that the Greeley CO housing market isn't looking like a typical spring season.

Sales decreased in April, and we're off to a slower start to what should be a fairly busy time. Sales continue to be concentrated on the higher end of the market. The price trend, particularly for median prices, has been mostly flat over the last year. And it's worth pointing out that this flatness is masking inflation somewhat - a $400k home today has fewer features and size than a $400k home of a couple of years ago. Inventory is at its highest level since October 2020, and has become much less of a factor in what's going on, while the sale price vs. list price index is starting to creep upward.

So, what is going on? The most likely factors influencing the real estate market are now firmly on the demand side of the equation. The fact is that fewer people can afford to buy a home as rising interest rates and inflation eat into disposable income. Employment instability and uncertainty about the economy make large investments appear more risky. And the bottom of the market continues to move upward, limiting the pool of potential buyers because of affordability.

The real estate market appears stable for now, but is in a generally reactive mode, and isn't likely to change much until there is more clarity about where the economy is heading. As always, we'll be watching closely, and we'll do our best to keep you informed. And, as always, we're here to answer any questions you may have.