This is the March 2023 Real Estate Market Report for Loveland CO

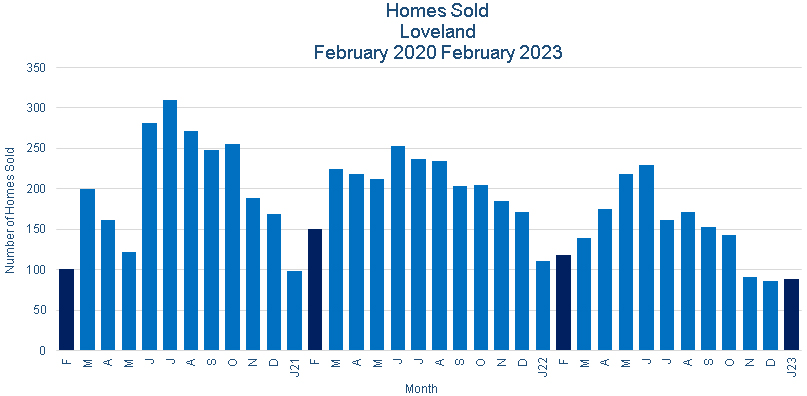

Sales:

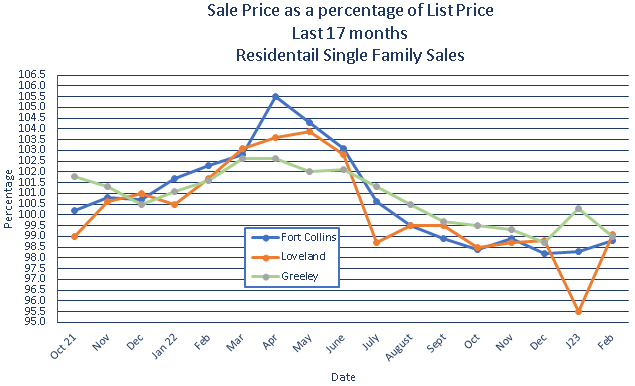

Sales of homes in Loveland CO rose in February 2023, with 95 sold, up 6.7% from the 89 sold in January 2023. Homes sold last month for an average of 99.1% of asking price, up from 95.5% in January 2023.

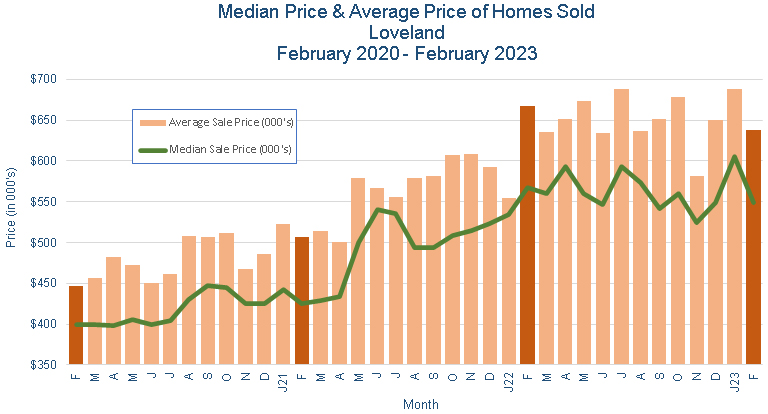

Prices:

Home prices declined in February 2023. The median price dropped to $549K down 10.2% from $605K in January 2023, while the average price fell 5from $688K to $638K, down 7.8%. Please note that this data only covers those specific homes sold during those two months.

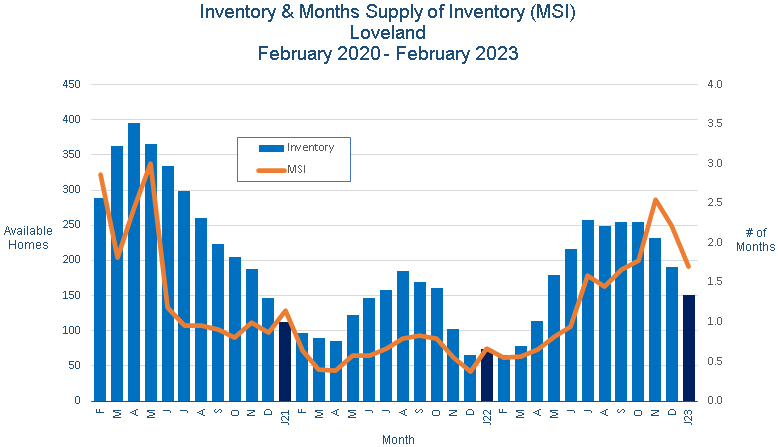

Inventory:

Loveland CO home inventory rose slightly in February 2023, from 151 homes for sale in January 2023 to 153 in February 2023, up 1.3%. The month's supply of inventory fell to 1.6 months from 1.7 months in January 2023, as sales gains outpaced inventory.

Sales Price vs. List Price:

In February 2023, homes in Loveland sold for an average of 99.1% of list price, compared to an average of 95.5% in January 2023.

Summary:

The Loveland CO housing market is still in the winter doldrums, but that's not the only factor behind this month's numbers.

We've seen a shift in activity towards the higher end of the market. The impacts of last year's early surge in prices, combined with continuing uncertainty about the state of the economy and rising interest rates, have limited buyer demand from the lower and middle ranges of the income spectrum.

Home sales have consequently skewed a bit toward the upper-mid to higher price ranges, where activity could currently be described as moderate. And this skewing is enhanced by the relative scarcity of available homes in the lower to lower-mid ranges. At the end of February, only 22% of the homes on the market in Loveland CO were priced at $500K and below.

Home prices have been relatively stable so far this year, with little evidence of inflationary pressure from external sources. While imbalances between supply and demand remain a significant factor, they are both caused and moderated by concern about the future of the economy and especially rising interest rates.

Inventory has yet to begin its usual spring recovery, which we also expect to be impacted by economic uncertainty.

In other words, there is no clarity yet as to where the 2023 real estate market may be heading. We're at the mercy of outside factors that have yet to reveal fully how they're going to impact the local market. As always, we'll be watching closely, and we'll do our best to keep you informed. And, as always, we're here to answer any questions you may have.