This is the May 2023 Real Estate Market Report for Loveland CO

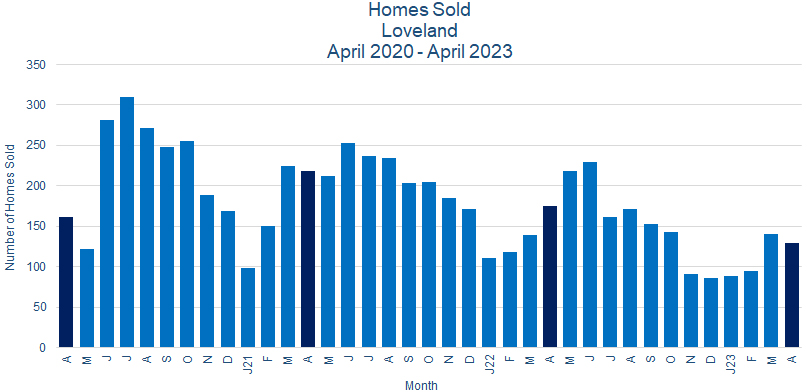

Sales:

Sales of homes in Loveland CO declined in April 2023. 129 homes sold, a drop of 9.3% from the 141 sold in March 2023, and a drop of 35.7% from the 175 homes sold in April 2022. 83 homes, or 64.3% of the total sold, were priced over $500K.

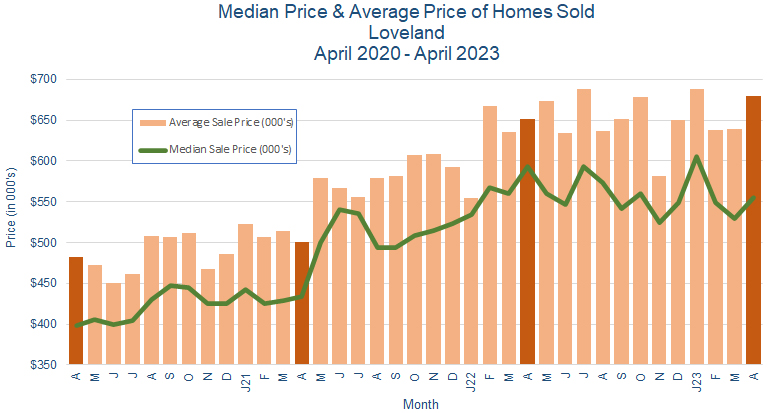

Prices:

Home prices rose in April 2023. The median price gained 4.6% to $555K from $530K in March 2023, while the average price rose 6.1% to $680K from $639K. Please note that this data only covers those specific homes sold during those two months, while the price trend over the last year has been generally flat.

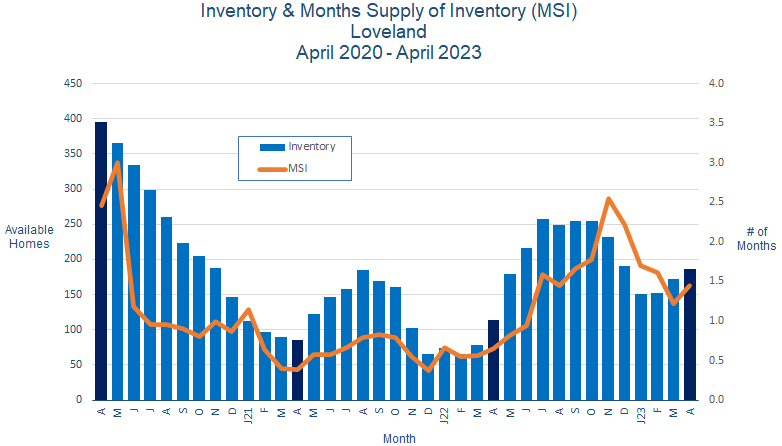

Inventory:

Loveland CO home inventory was up again in April 2023, with 187 homes for sale at the end of the month, a gain of 8.7% from 172 at the end of March 2023. The month's supply of inventory rose to 1.2 months, as inventory outpaced sales.

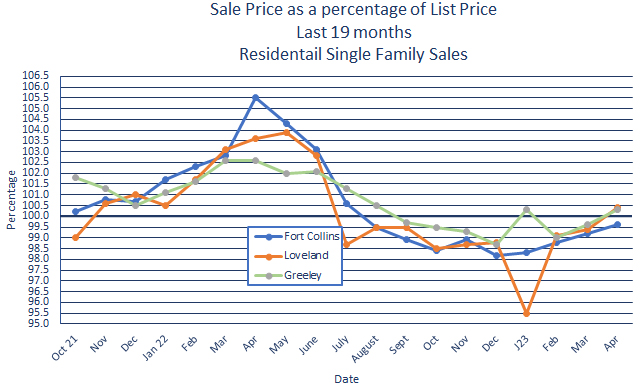

Sales Price vs. List Price:

In April 2023, homes in Loveland sold for an average of 100.4% of list price, compared to an average of 99.4% in March 2023.

Summary:

It's not really surprising that the Loveland CO housing market isn't looking like a typical spring season.

Sales decreased in April, and we're off to a slower start to what should be a fairly busy time. Sales continue to be concentrated on the higher end of the market. The price trend, particularly for median prices, has been mostly flat over the last year. And it's worth pointing out that this flatness is masking inflation somewhat - a $500k home today has fewer features and size than a $500k home of a couple of years ago. Inventory is at its highest level since October 2020, and has become much less of a factor in what's going on, while the sale price vs. list price index is starting to creep upward.

So, what is going on? The most likely factors influencing the real estate market are now firmly on the demand side of the equation. The fact is that fewer people can afford to buy a home as rising interest rates and inflation eat into disposable income. Employment instability and uncertainty about the economy make large investments appear more risky. And the bottom of the market continues to move upward, limiting the pool of potential buyers because of affordability.

The real estate market appears stable for now, but is in a generally reactive mode, and isn't likely to change much until there is more clarity about where the economy is heading. As always, we'll be watching closely, and we'll do our best to keep you informed. And, as always, we're here to answer any questions you may have.