This is the August 2023 Real Estate Market Update for Loveland CO

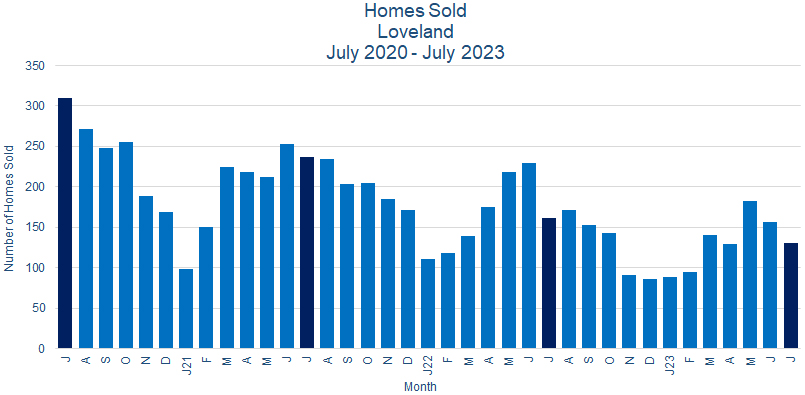

Sales:

Home sales in Loveland CO declined in August 2023. 131 homes sold, down 16.6% from the 157 sold in June 2023, and down 19.2% from the 162 homes sold in July 2022. 90 of these homes, or 68.7% of the total sold, were priced over $500K. 2023 year-to-date sales of 924 homes were down 19.8% from 2022’s 1152 sales for the same period.

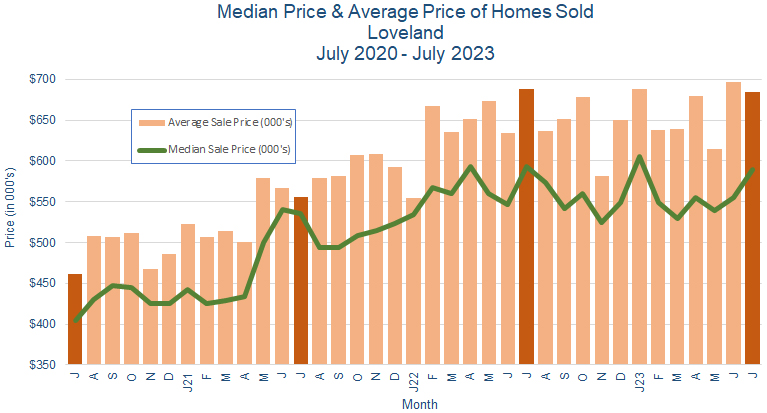

Prices:

Home prices were mixed in July 2023. The median price gained 6.3% to $590K from $555K in June 2023, while the average price dropped 2.7% to $684K from $696K. Please note that this data only covers those specific homes sold during those two months, while the price trend over the last year remains generally flat.

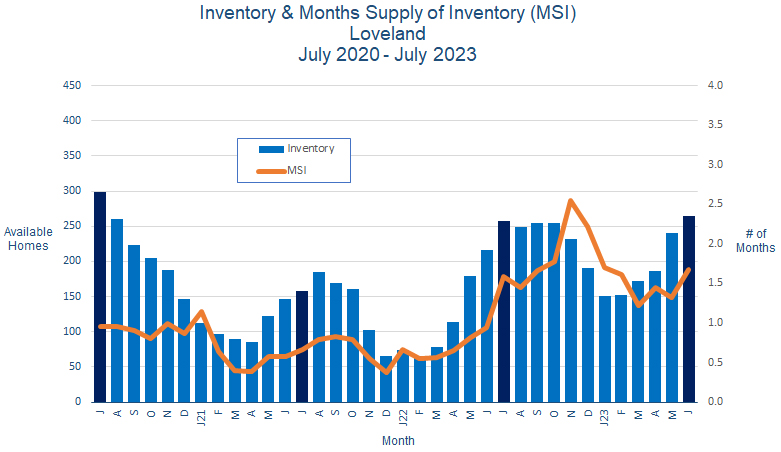

Inventory:

Inventory continued to rise in Loveland CO in July 2023, with 283 homes for sale at the end of the month, up 7.2% from 264 at the end of June 2023. The month’s supply of inventory rose to 2.2 months from 1.7 months the previous month, as inventory grew and sales declined.

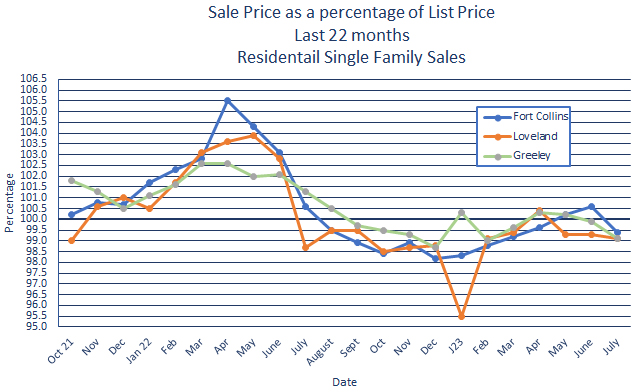

Sales Price vs. List Price:

In July 2023, homes in Loveland sold for an average of 99.1% of list price, down from 99.3% in June 2023.

Summary:

Sales were down, prices mixed, and inventory up during July 2023, typically one of the busiest months of the year. We would usually expect sales at a higher level, prices stable to rising, and inventory leveling off after increasing over the spring. But what has driven a typical July market is not what’s at work here.

While the upper third of the market seems to be working more or less normally, there is an imbalance between supply and demand in the low-to-mid price ranges. In those market segments, demand has been more constrained by the price and interest rate increases that affected all of the housing supply over the last 2 years. Simply put, prices, along with the costs of owning a home, have risen faster than incomes, and a substantial number of potential buyers have been priced out of the market. This effect has been magnified by uncertainty over job stability and the state of the economy.

And on the supply side, potential sellers, faced with that same uncertainty and a more expensive move up, have become more reluctant to sell, in spite of higher values on their current home. The result is simply that both the number of people capable of purchasing a home and the local real estate market have gotten smaller.

While there have been times when housing was a major driver in the economy, at this point the real estate market is in a much more responsive mode, subject to external conditions of uncertain outcome. For the time being, we can expect a continuation of these conditions. We’re entering a typically slower time of the year, and while we’re well out of “typical” range, there don’t appear to be any structural changes in the economy that would lead to rapid improvement in conditions.