This is the June 2023 Real Estate Market Update for Loveland CO

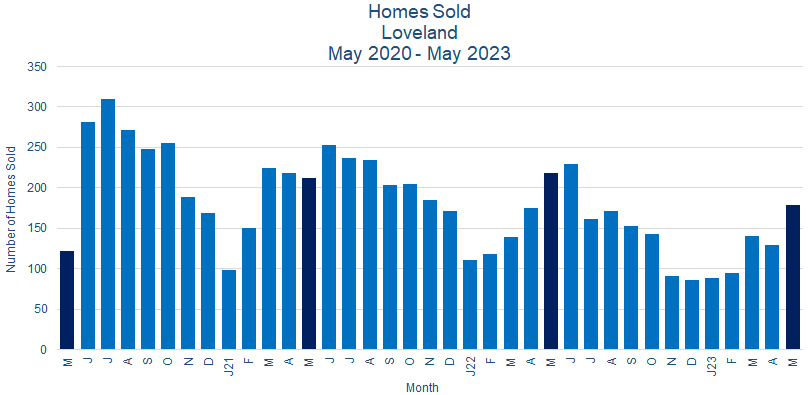

Sales:

Loveland CO home sales were up in May 2023. 182 homes sold, an increase of 41.1% from the 129 sold in April 2023, but a decrease of 19.8% from the 218 homes sold in May 2022. 117 homes, or 55.6% of the total sold, were priced over $500K. 2023 year-to-date sales of 636 homes were down 19.7% from 2022's 218 sales for the same period.

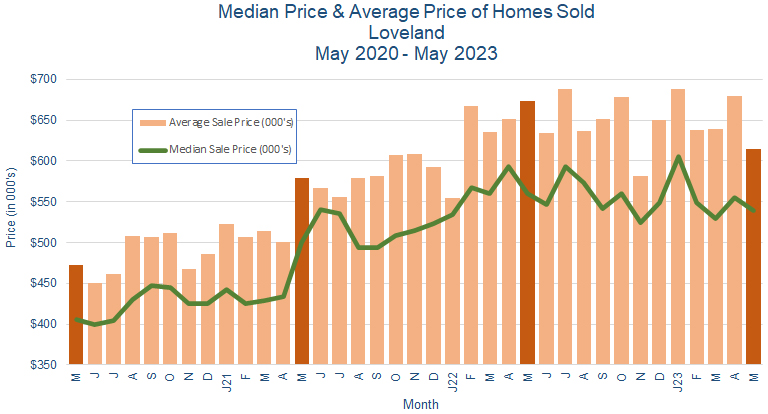

Prices:

Home prices declined in May 2023. The median price was down 3.0% to $539K from $555K in April 2023, while the average price fell 10.7% to $614K from $680K. Please note that this data only covers those specific homes sold during those two months, while the price trend over the last year remains generally flat.

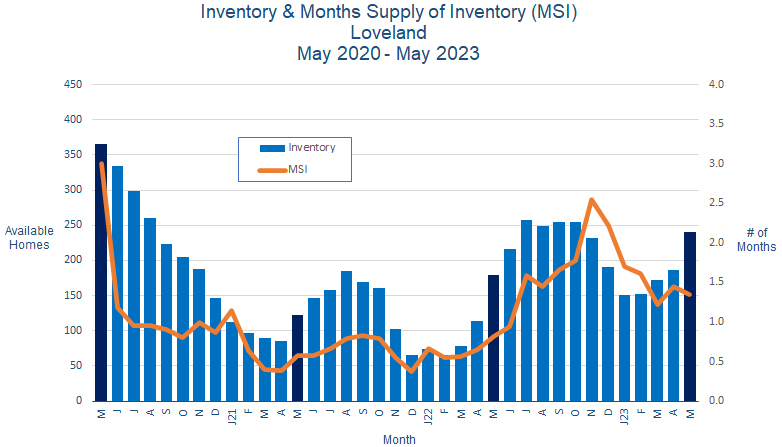

Inventory:

Loveland CO home inventory continued to rise in May 2023, with 241 homes for sale at the end of the month, up 28.9% from 187 at the end of April 2023. The month's supply of inventory fell to 1.3 months from 1.4 months the previous month, as sales rose a bit faster than inventory.

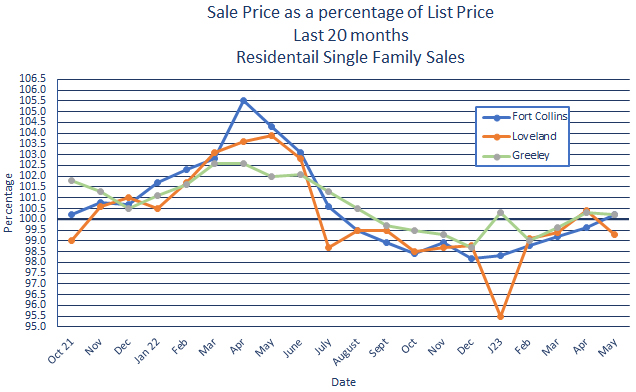

Sales Price vs. List Price:

In May 2023, homes in Loveland sold for an average of 99.3% of list price, compared to an average of 100.4% in April 2023.

Summary:

The Loveland CO real estate market became much more active in May 2023. Sales and home inventory both increased significantly, while prices were down but basically stable.

So does this mean that the real estate market is returning to normality? Probably not, given that so much has changed since we were last able to describe a market as "normal". More likely, we're seeing the market adjusting to significant changes in underlying factors affecting the economy. And unlike a few past notable instances, real estate is not driving any of these changes, but is very responsive to them.

However, the fact that our indicators are moving in a generally positive direction is cause for cautious optimism. Cautious, because we still have concerns: the persistence of inflation, higher interest rates, and the lack of available housing have priced a significant portion of our population out of the market; employment instability may play a part in the sharp rise in inventory; and a pervasive sense of uncertainty about the future of the economy is inhibiting investment overall. It's probably going to take a more resolved socio-economic-political environment to generate a real estate market that could be characterized as "normal".

The market is becoming more settled and focused, however. Homes are selling, but that's mostly those that are priced correctly - there's no current reward for over-enthusiasm. Prices are stable-to-rising, and there are currently enough homes to meet demand.

We'll be watching the market, as well as those factors most affecting it, very closely in the coming months, and doing our best to keep you informed. If you have any questions or concerns in the meantime, don't hesitate to give us a call. We're always available to help.