This is the June 2024 Real Estate Market Update for Loveland CO

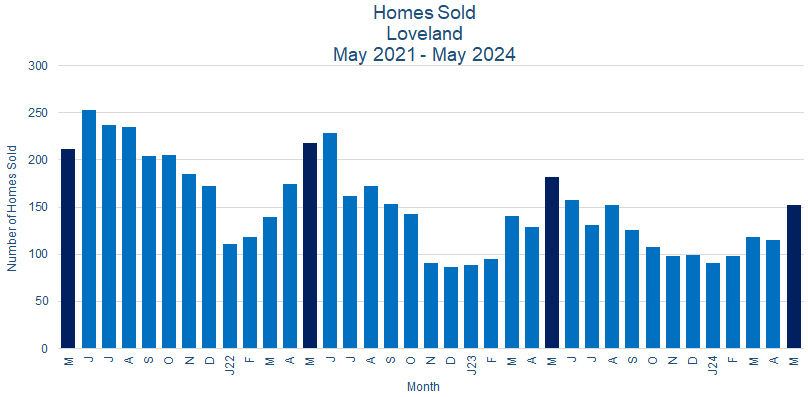

Sales:

152 homes sold in Loveland CO in May 2024, an increase of 32.2% from the 115 homes sold in April 2024, but a decrease of 19.7% from the 182 sold in May 2023. Year to date sales of 574 homes are down 10.8% from last year’s 636 sales for the same period.

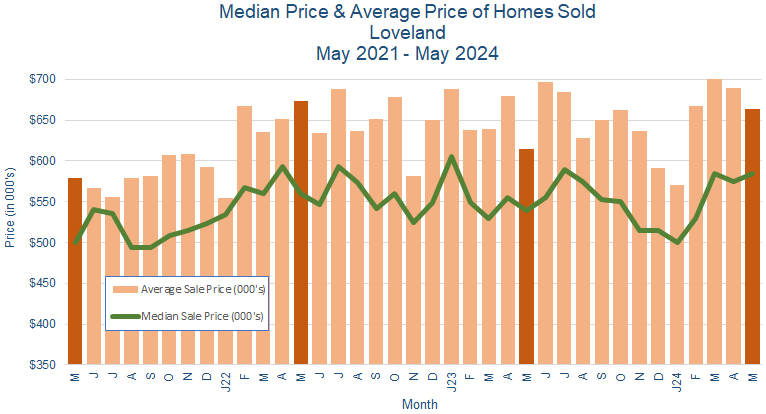

Prices:

Home prices were mixed in May 2024. The median price gained 1.7% to $585K from $575K in April 2024, while the average price fell 3.9% to $663K from $689K for the same period. May price results are for those specific homes sold during the month, and are minor deviations from the trend.

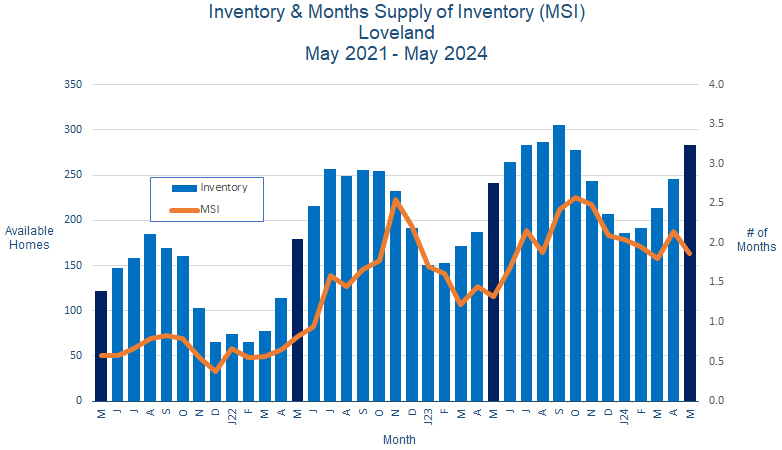

Inventory:

The inventory of available homes in Loveland CO rose to 283 at the end of May 2024, up from 246 homes for sale at the end of April 2024. The Month’s Supply of Inventory (MSI) fell to 1.9 months from April 2024’s 2.1 months.

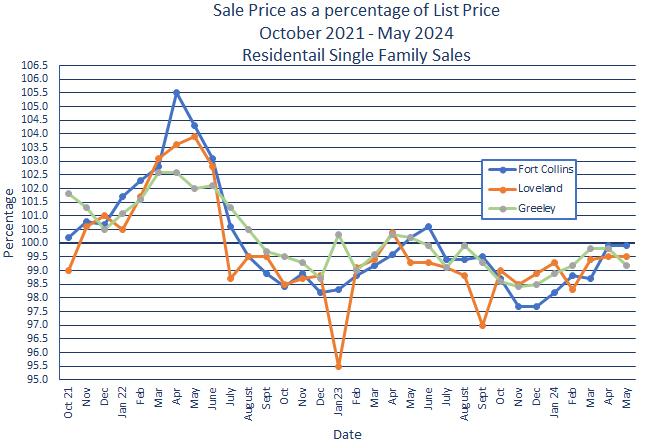

Sales Price vs. List Price:

In May 2024, homes in Loveland CO sold for 99.5% of asking price, unchanged from April 2024.

Summary:

So far in 2024, the Northern Colorado real estate markets are experiencing sales levels similar to 2023, moderately rising prices, and rising inventories. There hasn’t been a “normal” year post-Covid for comparative analysis, so each new year presents unique challenges in understanding what’s happening. This year looks to be a continuation of the results and patterns we saw last year.

We’re now into the start of what has traditionally been our busiest season, and sales are a bit slower than we expected, most likely due to a combination of previous year’s price increases, high interest rates, the failure of wages to keep pace with inflation, and concern about the state of the economy. Price increases, though moderate, are likely driven by inventory levels that, while currently increasing, are less than optimal, along with some secondary effects of inflation and a bit of competition for the more desirable homes currently for sale.

Our best guess for now is that at least until fall, we’ll see results similar to what is currently happening. At this time, we don’t see any signs of major instability or stimulus at the local, regional levels or state-wide levels. But we’ll be closely monitoring the markets, and we’ll keep you informed and up to date. In the meantime, please give us a call if you have any questions or just want to chat about what’s happening – we’d love to talk to you.